Introduction

With the aim of facilitating trade and payments as well as lower transaction costs among the countries in West Africa, the 16 countries of West Africa decided to come up with a single currency to be used by its member states in order to enhance free flow of goods and services within the sub-region. Therefore, the name of the currency would be called Eco and it will be like the Euro used by the European countries.

However, to achieve this single currency, the countries of West Africa needs to meet certain criteria divided into primary and secondary criteria. While there are four primary criteria, the countries of West Africa must also meet six other criteria which are the secondary criteria. The primary criteria are:

- Each Member country must have single digit inflation each year.

- The fiscal deficit of each member country must not be more than 4% of their GDP.

- A central bank financing should not be more than 10% of the previous year’s tax revenue.

- Gross external reserves of each member country should be able to cover at least three months of imports.

The six secondary criteria to be met by each member country before Eco can be implemented are:

- Tax revenue equal to or greater than 20% of Gross Domestic Product (GDP)

- A stable real exchange rate

- A positive real interest rate

- Public Investment to tax revenue equal to or greater than 20%

- Public Debt as a percentage of GDP not greater than 70%

- Wage bill to tax revenue equal to or less than 35%

During the meeting of the ministerial committee of Ministers of Finance and Governors of Central Banks of ECOWAS on the single currency, Nigeria’s minister of finance hinted that only Togo has met the primary requirements while the other countries have not.

However, during a meeting with the President of Ivory Coast, Emmanuel Macro (President of France) announced that the 8 French speaking countries in West Africa will no longer use the CFA, 50% of their reserves will no longer reside with the French and France will also cease to exist on the monetary board of the French speaking countries. As such, the French speaking countries will replace the CFA with “Eco” which would be tied to the Euro and would be guaranteed by France.

That said, this research work concentrates on analyzing how each of the West African Countries have performed in terms of meeting the inflation target, fiscal deficit, debt as a percentage of GDP, import cover as well as the target of tax revenue as a percentage of GDP.

Nine West African Countries Already Agreed to Adopt “Eco” as a New Currency

A day after the agreement between France and the French speaking countries in West Africa, Ghana too joined in the agreement after stating its desire to adopt the currency with a specific clause that the Eco should not be tied to the euro. This therefore brings the total number of countries in Agreement to 9 out of 16 leaving a shortfall of 7. What is confusing in this is the fact that these countries are no more talking about the criteria for the single currency to be achieved, just after France had an agreement with them. However, Nigeria still states that it would not join in the agreement unless there exist flexibility in the currency of countries within the sub-region, that member states pursue appropriate monetary policies, as well as undertake structural reforms so as to meet the fundamental criteria.

But They all Have Not Met the Conditions for Adoption of the New Currency

Inflation Rate in Three of the 16 Countries is still Double-Digit

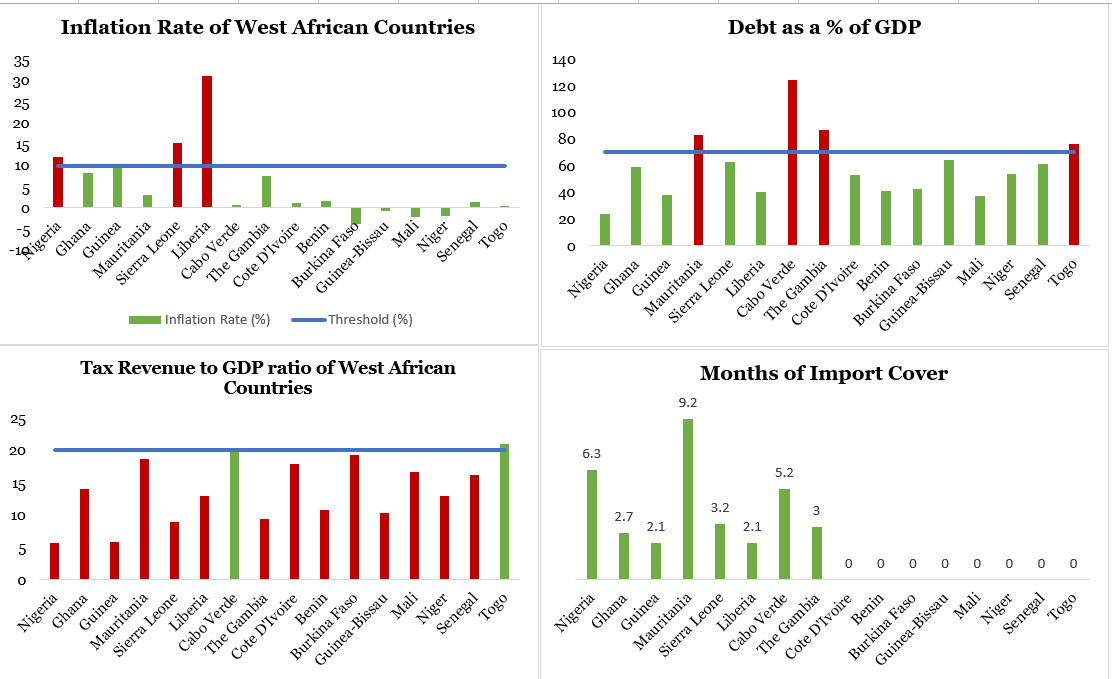

Based on the latest inflation figures of all the 16 countries in West Africa, only three countries still have double digit inflation figures and they are Liberia (30.9%), Sierra Leone (15.2%) and Nigeria (11.85%). This shows inflation rate within the sub region is low with the exception of the three countries mentioned. As such, the Single inflation criteria is yet to be met.

Based on the Data obtained from the Various Countries and Trading Economics

It is also interesting to note that four countries in West Africa are experiencing deflation (a case of persistent fall in general price level of goods and services over a period of time) and they are all French Speaking countries (Burkina-Faso, Guinea-Bissau, Mali and Niger). This is shown by their respective negative deflation figures of -3.8%, -0.7%, -2.2% and -1.9%.

12 of the 16 Countries Violate the Fiscal Deficit Limit of 4%

When a government has a fiscal deficit, it means it is spending above its means. A negative figure means the government is spending more than it has and a positive figure means it has a fiscal surplus (spending less than it has). According to the criteria set on fiscal deficit, the countries agreed that this fiscal deficit should not be more than 4% of a country’s GDP at any time. The data obtained from the International Monetary Fund (IMF) shows that none of the countries recorded fiscal surplus as at 2018 as all of them achieved fiscal deficit during the period.

However, four countries were able to have fiscal deficit below or equal to 4% of their respective GDPs and they are Guinea at 3.1%, Mauritania at 3.8%, Cabo Verde at 3.39% and the republic of Benin at 2.75%. Liberia has the highest fiscal deficit to GDP at 20.76% followed by Niger Republic with a fiscal deficit of 11.63% and the Gambia at 10.35% fiscal deficit to GDP ratio.

Based on the Data obtained from IMF

Countries Still Have Problems with three Months of Import Cover

The import cover is a measure of how many months the gross external reserve of a country can last if it is mainly used for the importation of goods and services. Therefore, import cover is calculated as a division of gross external reserve by the value of total imports over a given point in time. In visualizing the data for this aspect, all the French speaking countries were held constant as it is difficult to ascertain their total reserves given the fact that 50% of their reserves is kept with the France Government.

Based on the Data Obtained from World Bank

The criteria is for each of the countries to have gross external reserve that can cater for at least three months of imports. With gross external reserve of $42.84 billion (highest in West Africa) as at the end of 2018, Nigeria’s import cover was 6.3 months which is second to Mauritania which has an import cover of 9.2 months. Sierra Leone, Cabo Verde and the Gambia also have import covers of at least three months. Ghana, Guinea and Liberia all have import covers less than 3 months.

Two Countries alone meet the Tax Revenue to GDP Ratio of 20%

Based on the 2016 Data obtained from the Organization for Economic Co-operation and Development (OECD), average tax revenue to GDP of 26 African countries is 17.2% and calculations show that the average tax revenue to GDP of the West African Countries is 13.8% of which 7 of the countries fall below it. Given the criteria of tax revenue to GDP ratio of 20%, only Cabo Verde and Togo meets this criteria as the rest of the countries in West Africa have their tax revenue to GDP ratio at less than 20% with Nigeria having the lowest ratio among these countries. This shows that tax collection is still low among the countries of West Africa and the tax net therefore needs to be widened enough to include all the taxable individuals in each of the countries.

Based on the Data obtained from OECD

Mauritania, Cabo Verde, Gambia and Togo have Debt as a Percentage of GDP in Excess of 70%

Based on the Data obtained from the IMF

Among the 16 countries in West Africa, Nigeria has the lowest central government debt to GDP ratio at 24.08%. 11 other countries also have debt to GDP ratio less than 70% even though a handful of them have their debts as a percentage of GDP to be more than 50%. Cabo Verde which has more debts than its total GDP, leads the 4 countries that do not meet this criteria based on the data obtained from the IMF.

Will “Eco” therefore be Achievable in 2020?

As a result of France’s decision to back a new currency for French speaking countries in West Africa, there have been pressure on the part of the other countries to adopt the Eco. As a result, the criteria for adoption is no more talked about by the countries with the exception of Nigeria.

If the plan to adopt the Eco continues politically, it will not work as some countries will be cheated and at the end, each country goes back to using its individual currency. And as it is said, politics supersedes economics but if it happens in this case (abandoning the convergence assumptions), then the “Invisible Hand” will not make it last.

Therefore, it is safe to say that Politically, Eco can be achieved in 2020. Economically, it cannot be achieved in 2020.