By Tobias Adrian and Gita Gopinath

With inflationary pressures intensifying and Omicron generating new uncertainties, monetary policymakers are facing new and challenging tradeoffs.

The resurgence of the pandemic and the latest variant, Omicron, have sharply increased uncertainty around global economic prospects. This comes as several countries grapple with inflation well above their monetary policy targets. It is however evident that the strength of the economic recovery and magnitude of underlying inflationary pressures vary significantly across countries. Accordingly, policy responses to rising prices must be calibrated to the unique circumstances of individual economies.

We see grounds for monetary policy in the United States—with gross domestic product close to pre-pandemic trends, tight labor markets, and now broad-based inflationary pressures—to place greater weight on inflation risks as compared to some other advanced economies including the euro area. It would be appropriate for the Federal Reserve to accelerate the taper of asset purchases and bring forward the path for policy rate increases.

Over time, if inflationary pressures were to become broad-based in other countries, more may need to tighten earlier than currently expected. In this environment it is essential for major central banks to carefully communicate their policy actions so as not to trigger a market panic that would have deleterious effects not just at home but also abroad, especially on highly leveraged emerging and developing economies. Needless to say, given the extremely high uncertainty, including from Omicron, policymakers should remain agile, data-dependent, and ready to adjust course as needed.

The global inflation landscape

Rising energy and food prices have fueled higher inflation in many countries. These global factors may continue to add to inflation in 2022, especially high commodity food prices. This has particularly negative consequences for households in low-income countries where about 40 percent of consumption spending is on food.

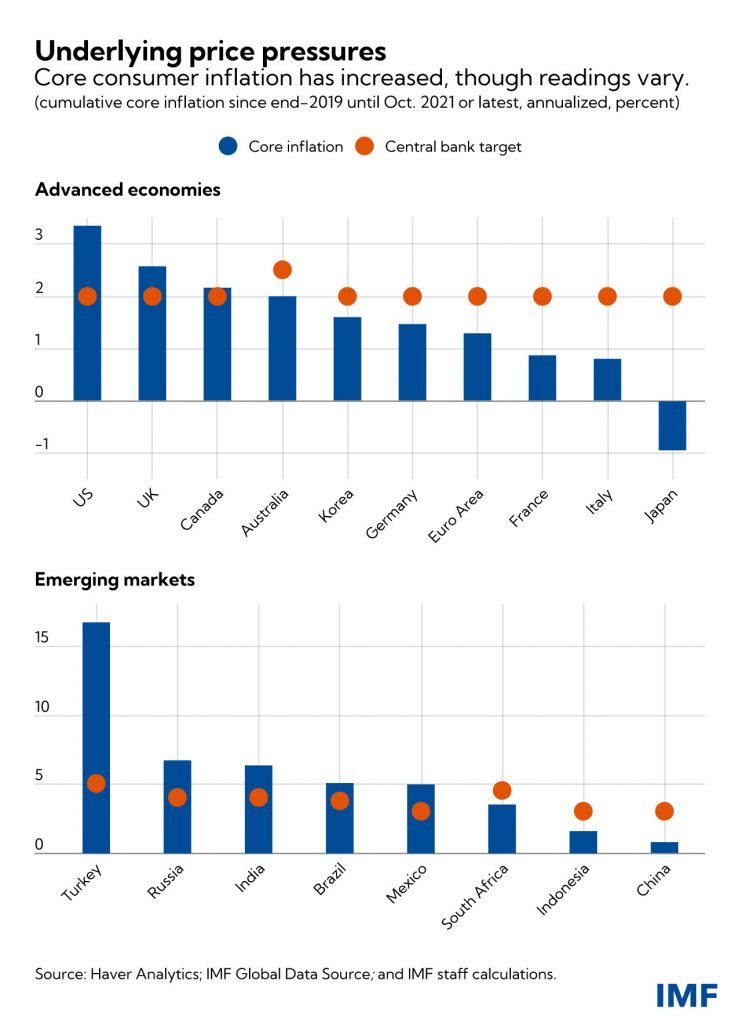

A measure of inflation which strips out volatile fuel and food inflation, so-called core consumer price inflation has also risen but exhibits significant variation across countries. Some of the increase in core inflation in countries reflects reversals of price falls in 2020, such as from the unwinding of VAT tax cuts in Germany. It therefore helps to focus on annualized cumulative inflation since pre-pandemic. By this measure, core inflation among advanced economies has risen most sharply in the United States, followed by the United Kingdom and Canada. In the euro area the increase is much less so. There are also limited signs of core inflationary pressures in Asia, including in China, Japan and Indonesia. Among emerging markets, core is dramatically elevated in Turkey.

Median inflation, a measure that is not affected by exceptionally large or small price changes in a few categories of goods and therefore conveys the breadth and likely persistence of price pressures, similarly varies across countries. The recent rise in median inflation for the United States to around 3 percent in October is also higher than for other Group of Seven countries.

While inflation is likely to remain elevated well into 2022 in several countries, measures of inflation expectations for the medium and long-term remain close to policy targets in most economies. This reflects, in addition to expectations of waning inflationary forces, that policy actions can bring inflation back to target.

In the United States, long-term inflation expectations have increased but remain close to historic averages and thus appear well-anchored. Euro area expectations have increased but from levels well below target to now close to it, which suggests long-term expectations may have become better anchored to the European Central Bank’s 2 percent objective. For Japan, inflation expectations remain well below the target.

For several emerging markets, including India, Indonesia, Russia, and South Africa, expectations show signs of being anchored. Exceptions include Turkey, where the risk of inflation expectations becoming unmoored is apparent as monetary policy is eased despite rising inflation.

Sources of price pressures

The rise in core inflation reflects multiple factors. Demand has rebounded strongly supported by exceptional fiscal and monetary measures, especially in advanced economies. In addition, supply disruptions caused by the pandemic and climate change, and a shift in spending toward goods over services have increased price pressures. Furthermore, wage pressures are apparent in some segments of labor markets. The United States has experienced a more prolonged reduction in labor-force participation relative to other advanced economies, further adding to wage and inflationary pressures.

We expect the mismatch in supply and demand to attenuate over time reducing some price pressures in countries. Under the baseline, shipping delays, delivery lags, and semiconductor shortages will likely improve in the second half of 2022. Aggregate demand should soften as fiscal measures come off in 2022.

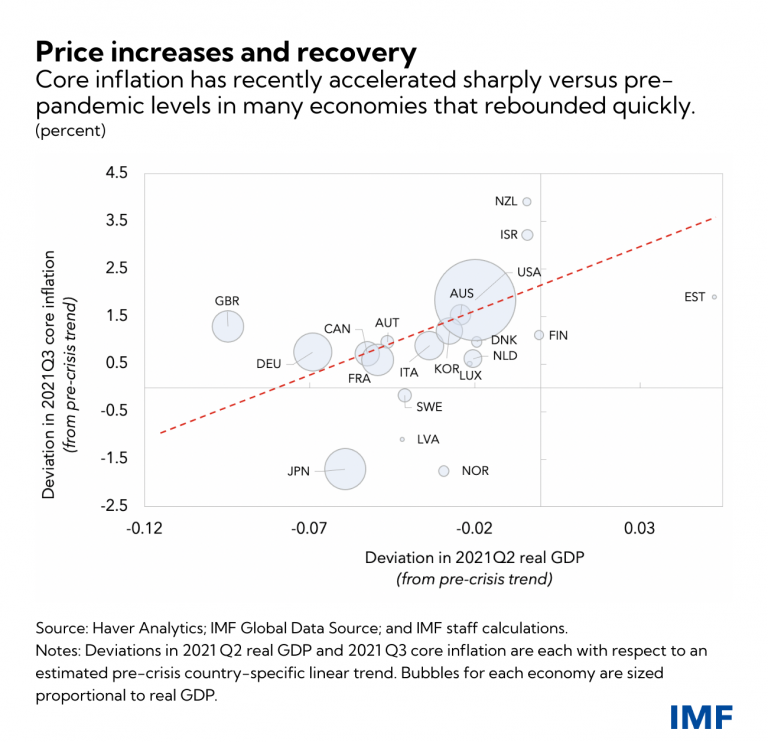

That said, it’s important to keep in mind that economic activity has rebounded quickly in several countries, with the United States experiencing the fastest recovery among large, advanced economies. It is in such countries, where economic activity has rebounded more quickly to pre-pandemic trends, that core inflation has risen sharply relative to levels before the crisis. This relationship between recovery strength and core inflation, while far from perfect, suggests stronger underlying inflationary pressures in countries where demand has recovered the fastest.

Varied policy action

At the onset of the pandemic, policymakers around the world were synchronized in dramatically easing monetary policy and expanding fiscal policy. These actions helped prevent a global financial crisis, despite lockdowns and health shocks causing a historic recession. The confluence of very low inflation and weak demand provided a strong rationale for easy monetary policies.

Earlier this year, when inflation picked up sharply, it was driven by exceptionally high inflation in a few sectors such as energy and autos, much of which was expected to reverse by the end of the year as pandemic related disruptions declined. Central banks, with a long track record of keeping inflation low and stable could appropriately “look through” the runup in inflation and keep interest rates low to support the economic recovery.

However, risks of a further acceleration of inflation previously flagged in our global publications and country-specific reports are materializing, with supply disruptions and elevated demand lasting longer than expected. Inflation is likely to be higher for longer than previously thought, which means that real rates are even lower than before, implying an increasingly expansionary stance of monetary policy.

While we still anticipate that supply-demand imbalances will wane next year, a singular focus of monetary policy on supporting recovery may well fuel substantial and persistent inflationary pressures, with some risk of de-anchoring inflation expectations. Accordingly, in countries where economic recoveries are further along and inflationary pressures more acute it would be appropriate to accelerate the normalization of monetary policy.

Potentially challenging spillovers

The challenge of addressing large and persistent supply shocks is even greater for emerging market central banks. Given the greater risk to de-anchoring of inflation expectations relative to advanced economies, they see the need to get ahead of inflationary pressures and some—such as Brazil and Russia—have raised policy rates sharply. Such tightening comes amid large COVID-related output shortfalls and could further depress output and employment. Emerging markets face potentially challenging spillovers if tightening by advanced economies causes capital outflows and exchange rate pressures that could require them to tighten even more.

Lastly, there remains tremendous uncertainty around the evolution of the pandemic and on its economic consequences. A variant that significantly reduces vaccine efficacy could lead to further supply chain disruptions and contractions in labor supply pushing up inflationary pressures, while lower demand could have opposing effects. The sharp fall in oil prices following the discovery of Omicron and the rapid imposition of travel restrictions by countries is a sign of the volatility ahead.

In sum, policymakers must carefully calibrate their response to incoming data. Varying inflation conditions and strength of recoveries across countries show why the policy response needs to be tailored to country specific circumstances, given sharply higher uncertainty associated with Omicron. Clear central bank communication, too, is key to fostering a durable global recovery.

As we warned in recent reports such as the World Economic Outlook, a more frontloaded Fed response to dampen inflation risks could result in market volatility and create difficulties elsewhere—especially in emerging and developing economies. To avoid that, policy shifts need to be telegraphed well, as has so far been the case. Emerging market and developing economies should also prepare for increases in advanced economy interest rates through debt maturity extensions where feasible, thereby reducing their rollover needs, and regulators should also focus on limiting the buildup of currency mismatches on balance sheets.

CREDIT: The Post Addressing Inflation Pressures Amid an Enduring Pandemic first appeared in the IMF Blog on 3rd December 2021.