by Greg Rosalsky and Darian Woods / PlanetMoney

Last week, global markets shook after a Chinese company named Evergrande fell into what looks like a downward spiral into oblivion. Evergrande is — or was — the second-largest real estate company in China. A couple years ago, it was the world’s most valuable real estate stock. It’s also been involved in an eclectic mix of other businesses, from mineral water to electric cars to pig farming. It even owns a professional soccer team. But recently it’s been having a really hard time repaying a mammoth amount of debt, a whopping $300 billion worth.

The Evergrande story is bigger than just one company. It’s about China’s unsustainable model of economic growth, which has relied on endless investment and a mad, debt-fueled development frenzy in recent years. That model helped China soar, but the country is now experiencing some turbulence. Last week, some alarmist observers were calling this China’s “Lehman moment” — a reference to the collapse of Lehman Brothers that preceded the 2008 financial crisis — but China-focused economistsargue that’s overblown.

Nonetheless, given how interconnected the global economy is, investors remain worried about the future of the Chinese economy. It’s been a nuclear reactor powering the globe’s economic growth. Troubles there could have ripple effects around the world.

We decided to put together a little listicle about what we’ve learned from the Evergrande story so far.

1) Real estate has been a huge part of China’s economic growth

China’s economic growth in recent years has been powered in large part by its roaring real estate market. The real estate industry, directly and indirectly, accounts for as much as 29 percent of China’s entire GDP. This growth has been fueled by a ginormous property bubble and mounting amounts of debt. For a while, China’s national and local governments used their massive powers of command-and-control over the economy to keep the bubble inflating. As is commonly the case in bubbles, investors and companies have taken on massive amounts of debt to capitalize on surging real estate prices. Evergrande itself amassed more than $300 billion in debt, to its banks, its bondholders, its suppliers, and its customers, many of whom pre-bought homes months, even years, before they were built.

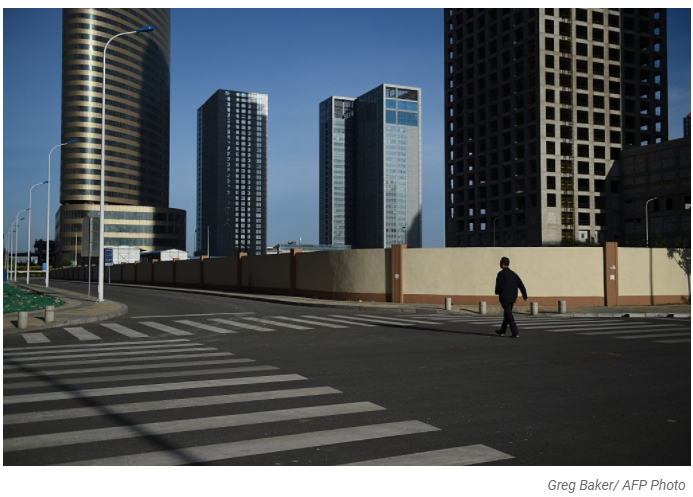

2) China’s property bubble has created spooky “ghost cities” and “ghost apartments” throughout the nation

The Chinese property bubble, which observers have been talking about for years, has encouraged more and more speculation, with investors buying up properties with no intention of living in them. Unfinished and vacant buildings and apartments litter the provinces of China. Estimates vary, but around 20% of China’s total housing stock now sits unoccupied. The Financial Times says there is now enough vacant property in the nation to house more than 90 million people. That’s enough empty homes to fit the entire population of Canada. Or France. Or Germany.

In some cases, entire urban areas lie empty. These so-called “ghost cities” include replicas of Paris, Venice, and even Jackson Hole, Wyoming.

3) The Communist Party of China is now working to reduce financial risks and change its model for economic growth

One of the main differences between Evergrande’s debt crunch and the collapse of Lehman Brothers is that this crunch was brought about on purpose. The Communist Party of China (CPC) has been aware of the dangers posed by its wild real estate market for some time. In 2017, President Xi Jinping began signaling he wanted to do something about it with a speech to the 19th Party Congress. He said, “Houses are built to be inhabited, not for speculation.”

Last year, the government followed up with a policy known as “three red lines,” which aims to reduce debt in the property market, crack down on reckless borrowing, and prevent a market correction from turning into a cataclysm. The historian Adam Tooze calls it “controlled demolition” of the real estate bubble.

More broadly, Xi has been pursuing radical new policies in the name of “common prosperity,” an effort to fight growing inequality in China and intervene more forcefully in private industries.

In July, Xi released an essay outlining his ambitions for China. He said he wants the country to focus on “pursuing genuine rather than inflated GDP growth and achieving high-quality, efficient, and sustainable development.” Evergrande, a poster child for excesses of the real estate market, apparently does not represent genuine economic growth. And government policies, which once boosted the company, are now strangling it.

4) Cronyism May Have Lulled Investors and Creditors Into Overconfidence In Evergrande

Evergrande was founded by Xu Jiayin, who not that long ago was the richest man in China. Jiayin is well connected. He is a member of the Chinese People’s Political Consultative Conference, an elite group of advisers to the government. He’s also politically shrewd. For example, he reportedly got Evergrande to buy Guangzhou Football Club after President Xi Jinping said he wanted China to have a great soccer team. The company then sank millions buying some of the best soccer players in the world.

The New York Timessuggests that Xu Jiayin’s connections gave investors and creditors confidence that the company could keep borrowing and get bailed out by the government if things went bad. They thought Evergrande was too big and too connected to fail. In August, however, as the company began to wobble, Xu resigned as chairman of Evergrande’s real estate arm, sending it tumbling further.

5) Evergrande may be just the tip of the iceberg

China’s growth in recent years has depended heavily on a gargantuan expansion of real estate and all its accoutrements — trains, bridges and sewers. China has been building and building and building, creating lots of economic activity in the country. With Evergrande, that type of growth is finally showing itself to be unsustainable — and the Chinese economy is in for a period of turbulence. The weird part is this seems to be, in part, by design.

We still have questions. How forcefully will China act to contain the damage done by Evergrande? Will China be able to successfully shift its economic model away from real estate and endless development? How will this shift affect the broader global economy? We’ll be paying attention in future weeks.

CREDIT: The Post Five Lessons Evergrande Taught Us About The Chinese Economy first appeared in NPR on 28th September 2021.