Background.

After nearly five decades of the Nigerian government subsidizing fuel costs for its citizens, the policy came to an end when President Bola Ahmed Tinubu announced the removal of fuel subsidy at his inauguration on May 29, 2023. Despite this announcement, the subsidy was not fully phased out until October 2024.

The removal of fuel subsidy was expected to boost Nigerian National Petroleum Company (NNPC)Limited’s remittances into the Federation account. However, the full impact of removing the subsidy on the Federation account, and by implication, CBN’s gross FX reserves, lagged until recently.

NNPC Remittance Trend before and after Subsidy Removal.

Between January and May 2023, NNPC remittances comprising Joint Venture profit, Joint Venture Royalty, Joint Venture Petroleum Profit Tax (PPT), and Federation Share of Production Sharing Contract (PSC) were recognized as payables rather than actual cash transfers, owing to subsidy-related arrears yet to be paid for by the government. Over this same period, the cumulative outstanding subsidy costs increased by over 57% within five months, reaching ₦3.74 trillion by May 2023. As the subsidy costs piled up and diminished the entity’s gains, NNPC was unable to make actual remittances and instead recorded the amounts as payables to be carried forward.

After 18 months of not making a remittance to the government since January 2022, NNPC finally remitted $3.95 million into the Federation account as its PSC profit share in June 2023 and a dividend amount of ₦81.17 billion, which came to a total amount of ₦123.65 billion.

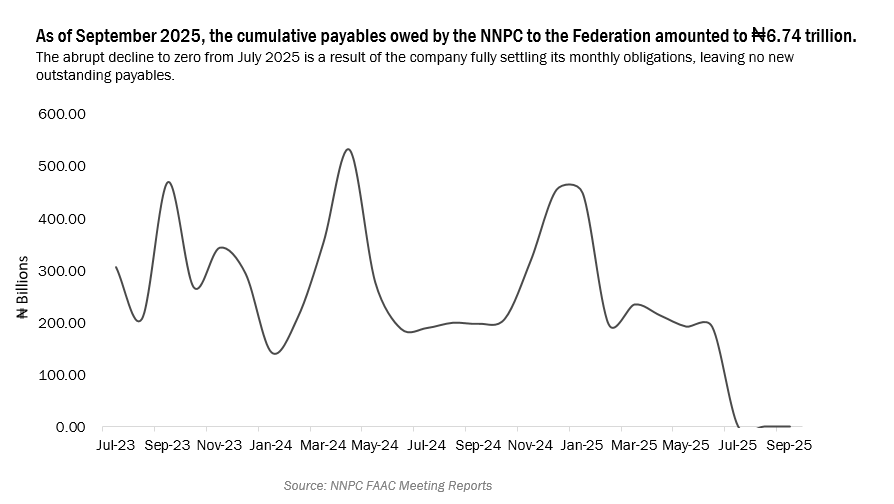

By December 2023, NNPC remitted $14.98 million into the Federation account and a dividend amount of ₦81.17 billion, bringing the total remittance to ₦155.16 billion. The total amount of remittances NNPC paid to the federation in 2023 (July 2023 – December 2023) amounted to ₦1.16 trillion. On the other hand, the total payables at the end of 2023 stood at ₦2.03 trillion. These payables refer to the outstanding payments from NNPC’s revenue, that is, the federation’s share from the company’s earnings, for which remittance has been delayed due to cashflow constraints arising from high operating costs incurred during those periods. Fast forward to 2024, NNPC remitted a total of ₦680.15 billion, and the cumulative payable for the year was ₦5.16 trillion. The decline in remittances to the Federation between 2023 and 2024 can be attributed to the increase in the implicit subsidy costs from the exchange rate differential.

How did the Exchange rate differential act as a form of backdoor subsidy?

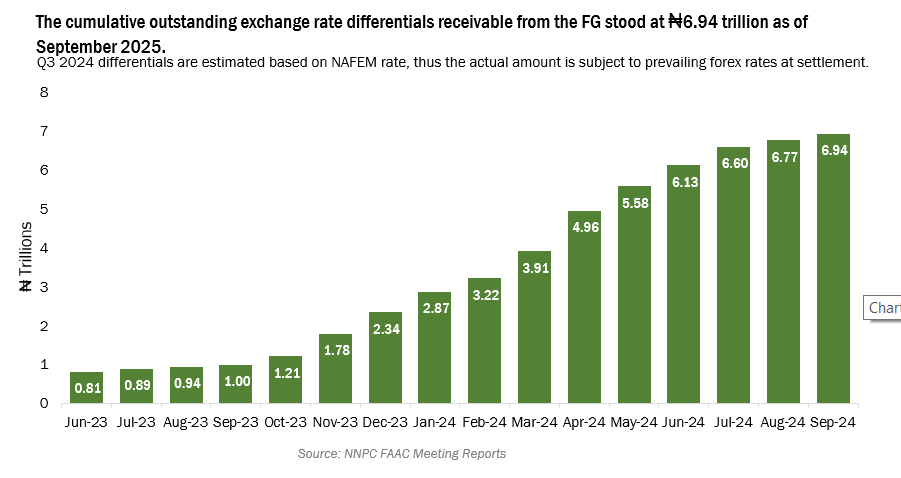

NNPC purchases Premium Motor Spirit (PMS) in dollars but sells it domestically in naira, creating a currency gap that widened after the naira’s devaluation. Shortly after the fuel subsidy was removed, the Central Bank of Nigeria (CBN) announced the unification of the foreign exchange market in June 2023. This significant depreciation of the naira sharply increased landing costs incurred by the NNPC in naira terms, resulting in a significant gap between NNPC’s import costs and the selling price of PMS. To bridge this gap, the Federal Government agreed to cover the exchange rate differential, effectively reintroducing a backdoor subsidy.

At the end of 2023, the exchange rate differential was ₦1.68 trillion. By the end of 2024, it had increased by 562.08% to ₦11.12 trillion, despite the subsidy being fully phased out in October 2024. The Federal Government has paid ₦2.76 trillion to cover part of the differential, leaving a cumulative outstanding of ₦6.94 trillion as of September 2025. This exchange rate burden was the major driver of the 41.37% decline in remittances received from NNPC in 2024, from ₦1.16 trillion in 2023 to ₦680.15 billion in 2024. A significant portion of NNPC’s earnings was diverted to offset exchange rate differential costs, limiting its capacity to remit more funds into the Federation Account. As a result, NNPC payables to the Federation rose by 154.19%, increasing from ₦2.03 trillion in 2023 to ₦5.16 trillion in 2024.

2025 Progress Update

As of September 2025, the total amount remitted to the federation for its proportion of production sharing contract (PSC) profit is ₦425.07 billion, with zero calendarized dividend remitted to the government during the year. The quarterly trend shows a 38% decrease in remittances from ₦175.42 billion in Q1 to ₦109.61 billion in Q2 2025, followed by a 21% rebound in Q3.

Remittances to the Federation, covering production sharing contract (PSC) profit, tax, and royalty obligations, surged by 2,127% from $27.19 million in January 2025 to $605.62 million in September 2025. The sharp rise in remittances beginning from May 2025 followed a resolution that allowed NNPC to retain part of its monthly obligations to the Federation as deductions against the federal government’s outstanding subsidy arrears. This arrangement remained in place until July 2025, when the company decided not to withhold any amount again but to pay the full amount due to the Federation. Hence, the sharp increase in September reflects NNPC’s shift to fully settling its remittance obligation. Meanwhile, the federal government’s cumulative debt to NNPC from exchange rate differentials stands at ₦6.94 trillion, which is subject to adjustment based on the prevailing exchange rates at the time of settlement.

Future Outlook

The recent rise in NNPC remittances marks a positive development for Nigeria’s revenue profile. With payments made in U.S. dollars, these inflows have also supported growth in foreign exchange reserves. FX reserves increased from US$37.9 billion at the end of April to more than US$42 billion at the end of September. This increase has also supported positive domestic and foreign sentiment, with the net impact being an appreciation of the currency to below NGN1,500/USD since 15 September. The increase in FX reserves, supported by higher USD remittances by the NNPC, also increases the ability of the CBN to support the currency during periods of excessive volatility. Barring any unforeseen negative shock, FX reserve is seen to increase towards USD43.0bn by the end of the year after accounting for expected FX outflows to cater for FX demands, and the likelihood that NNPC’s monthly remittances to the Federation account, by implication, the FX reserves may rise to USD1.0bn in the near term.

However, the potential for higher inflows remains largely untapped. Crude oil production grew by only 13% between January 2023 and July 2025, from 1.51 million barrels per day to 1.71 million barrels per day. This shows the level of underinvestment in the Nigerian oil sector. To sustain and expand the fiscal gains from NNPC operations, the government must increase targeted investments to boost crude oil production capacity and ensure that subsidy arrears do not re-emerge under different forms. Only then can the expected benefits of subsidy removal translate into sustained fiscal gain.

Wow. Interesting read.

What a positive sign in NNPC remittance and I hope we can surpassed the current daily output.

My question is, since NNPC is now fully remitting his due to the federation as against the previous practices of deducting what government owes, how would the ₦6.94 trillion now be paid back to NNPC?

It is still not clear if the full remittance will persist and we are unclear as to the agreement made for NNPC to stop deducting from FAAC allocations since July.

Great analysis. This is really well written and clear!

Great research and analysis my girl! Well done, this is well put-together.