The Event

The Minister of Finance during a public hearing of the 2021 budget highlighted the performance of the 2020 budget during the section of the 2020 budget implementation report. Based on the presentation, we highlight that the total revenue was N3.94 trillion while the total expenditure was N10.08 trillion, thereby leaving the total deficit at N6.15 trillion.

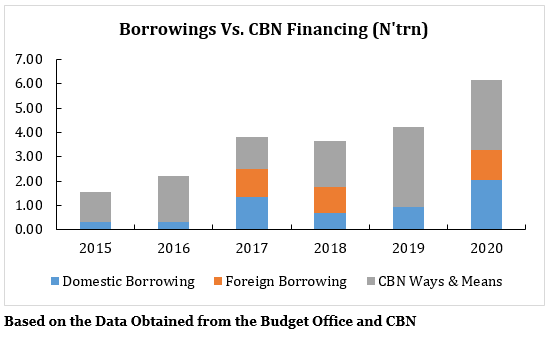

What became of interest to us was the financing of the deficit. We highlight that out of the total deficit of N6.15 trillion, 47% or N2.86 trillion was financed by the Central Bank of Nigeria (CBN) through its Ways and Means.

Recommended Reading – FAQ on FGN Frustrating the CBN from Pursuing its Monetary Policy

A Recap of ECN101

During a fiscal year, the Government presents its budget and when expenditure is greater than revenue, we have a fiscal deficit. The fiscal deficit is majorly financed from selling assets, borrowing from the domestic and international market, getting grants from multilateral institutions. However, most of the time, actual revenue comes in lower than expected and actual expenditure comes in greater than expected. This means that the fiscal deficit will be wider, thus paving the way for the CBN to come in through its ways and means. Note that this situation is most peculiar to developing countries, and it has been very obvious in the Nigerian scenario as it happens most of the time.

Continuation of Paragraph 2…

On the first thought, you would not see a problem with the CBN financing in 2020 because there was a Pandemic which is like a one-off event. Hence, it shattered Federal Government (FGN) revenue amid the need to spend its way out of recession. As such, the CBN should help with printing money for the FGN while the FGN gives it bonds. The same is true for the advanced economies where fiscal and monetary stimulus packages were the order of the day. As a matter of fact, about 25% of all U.S. dollars created in history, were printed in 2020.

On the second thought, CBN’s financing of the FGN deficits seems to be a structural one and not a one-off event. This is because historical data has shown that the CBN has been financing a huge part of the FGN deficits even when there was no economic downturn. For example, out of the total fiscal deficit of N3.64 trillion in 2018, the CBN financed 52.2%. In 2019, the total fiscal deficit was N4.23 trillion and the CBN financed 78.3% or N3.31 trillion of that amount. There was no downturn during those periods, hence it goes against economic theory for the CBN to be printing money to finance significant proportions of the FGN’s fiscal deficit.

A Bigger Problem

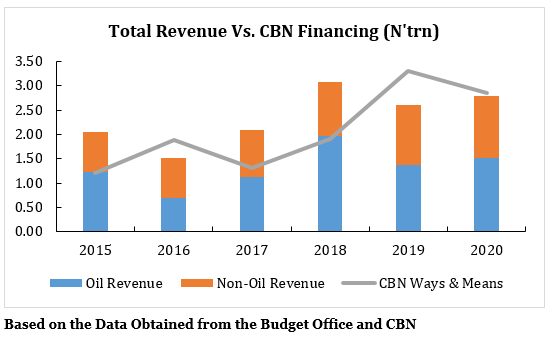

The problem even gets bigger when you compare the CBN’s financing of the FGN’s deficit with tax and non-tax revenue. Digging through, we saw that CBN’s financing of the FGN has been bigger than each of the oil and non-oil revenue when held in isolation. For example, oil revenue was N1.13 trillion in 2017 while the CBN’s Ways and Means to the FGN was N1.3 trillion. In 2019, the situation became worse – oil and non-oil revenue totaled 2.61 trillion but the CBN’s financing of the FG was greater at N3.31 trillion.

The preceding points out that the FGN do not seem to care at all about boosting revenue, since they have the CBN there for them to be printing money for their operations. One implication of this is that by the time the CBN becomes handicapped to finance the FGN’s operations, the FGN will breakdown because it would not have ways to fund its operations and that will generate internal imbalance with the attendant effect of sending a signal to the external sector. Another implication is in terms of liquidity in the system, excess of which not backed up by productivity contributes greatly to an increase in the rate of inflation in the economy. In other words, if the rate of printing money grows faster than economic output, it reduces the value of money and sequentially causes inflation. This gradually generates hyperinflation and would cause significant damages to the economy. Besides, exchange rate is also adversely affected because of the excess liquidity that has been injected into the economy. All these points to macroeconomic instability arising from the excess liquidity injected into the system.

Recommended Reading – The Economics of Printing the Naira

FGN Wants to Become More Accountable

To become more accountable to the ‘loans’ obtained via the CBN, the Minister of Finance made it known that they are in talks to formalize the CBN’s financing. This means that the CBN will now sell the loans to the public in form of a bond while the public gives the CBN the money. This means that the burden will now be lifted from the CBN and the FGN becomes accountable to the citizens in terms of repayment. This is expected to be positive because the thought of not wanting to default in paying the citizens, will make the government serious in terms of revenue generation and cutting unnecessary spending.

What then does the CBN Accounts Say?

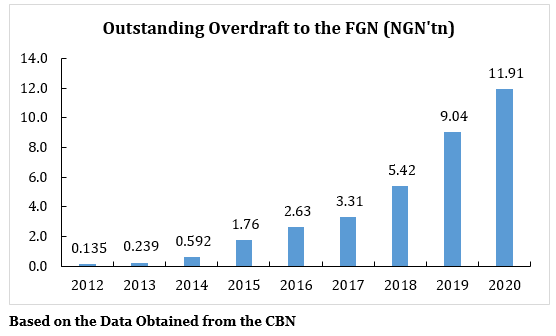

Checking through the monetary account of the CBN, we realized that the outstanding balance of the bank’s overdraft to the FGN was N9.04 trillion as of December 2019. If we add the 2020 CBN financing of N2.86 trillion to that amount, it means the total outstanding overdraft at the end of 2020 will be N11.91 trillion. However, when we use the total bond allotment of 2020 for calculations, we realized that it will take approximately six years for the FGN to securitize the total outstanding overdraft and that is if they do not offer any other bond in 2021 which is very unlikely.

With the FGN offering bond to finance the 2021 budget, it then means it will take several years to formalize the loans especially as they do not want to surrender the low-interest environment soon. If the FGN then decides to be aggressive in the securitization, it means yields will likely increase significantly this year, and the aggressive securitization will also crowd out private sector borrowing, which will tend to constrain growth.

For questions, opinions, corrections, and contributions, please drop them in the comment section. You can as well contact the writer on Twitter @K2ice_Jr

With no remorse for the past and present as the situation persist, future generations dwell in great setback for the actions and inactions of today’s dramatical relationship between the FGN and CBN.

Really insightful write-up. The explanation was simple, yet it was detailed and comprehensive.