Introduction

Nigeria practices the federal system of Government in which the governmental powers are shared between the Federal Government (FG) and its components (States and Local Government). This is so because the country is too large for only a tier of government to oversee the affairs of all the citizens of the nation, and as such, leads to unbalanced development as the government tend to neglect some areas. Therefore, there are three tiers of government in the country of which the Local Government is vested with the power to govern the citizens at the grass-root level. The Local Government therefore performs grass root functions such as construction and maintenance of local roads, control and regulation of outdoor activities, collection of taxes and levies at the local level, provision and maintenance of public vehicles, etc.

That said, there have been different views on the activities of the 774 local government in Nigeria as the need to cut down expenditure arises while ensuring growth among all areas of the country. This article therefore seeks to provide empirical answers to the activities of local government in Nigeria based on their finances.

Table 1: Summary of Local Government Finances Since 2015

Over the past four years, Local Governments (LGs) just like the states and Federal Government (FG) have been operating on deficit and the deficit of 2015 was financed largely through loans from commercial banks. The highest deficit occurred in 2016 when the Nigerian economy plunged into recession as it was during this period that revenue and expenditure were lowest. The reason for this was the low amount of money gotten from the federation account (which is largely influenced by the price of crude oil in the international market based on the mono cultural nature of the Nigerian economy).

In 2017, the 774 LGs in Nigeria earned N1,338bln as revenue of which 62% came from the federation account (55% in 2016 and 72.5% in 2018) and recorded 60 million naira deficit largely due to an increase in recurrent expenditure (82% of the total expenditure). In 2018, deficits reduced to 20 million naira and this was also financed domestically. Therefore, it is seen that the 774 local government in Nigeria are consciously trying to keep a low deficit profile as their revenue is largely dependent on allocations from the federal government.

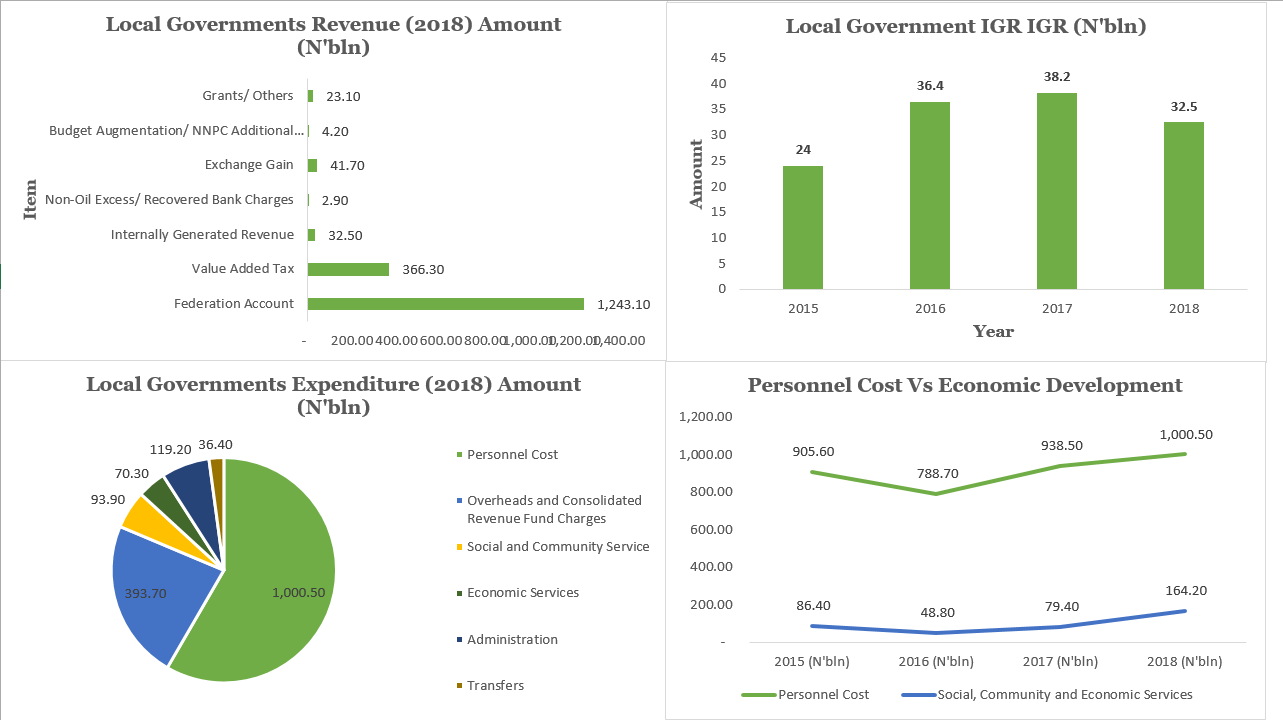

Illustration 1: Sources of Local Government Revenue (2018)

Source: CBN, Gifted Hands Research

In 2018, the 774 local government in Nigeria earned N1.72 trillion with N1.24 trillion coming from the addition of the 12 months federal allocation to the local government in a fiscal year. Another variable of interest is the aggregate amount of money generated from IGR by the 774 local governments. Analysis of the contribution of each of the states to the IGR shows that the 20 local government in Lagos state generated N4.58bln (representing the highest contribution at 14.1%) while Kwara state ranked the lowest with 13 million naira (0.4%) generated as IGR in 2018.

On an average basis, the IGR of the 20 local government in Lagos State shows that each local government Lagos state in 2018 generated 229 million naira in 2018 (highest range) while the 16 local government in Kwara state each generated 812,500 thousand naira as revenue in 2018 (lowest range).

Illustration 2: Local Government Expenditure (2018)

Source: CBN, Gifted Hands Research

Approximately 58% of the total expenditure of all the 774 local government in Nigeria went into the remuneration of workers in the form of personnel cost while N319.8bln was spent on capital expenses in 2018. Direct and indirect expenses (represented by recurrent expenditure) amounted to a whopping 81.3% of the aggregate expenditure. What concerns economic development in the local government represents the meagre sum of N164.20bln which means that on the average, each of the local government in Nigeria spent about N212 million in 2018 on economic, social and community services.

Illustration 3: Local Government IGR in Four Years (2015-2018)

Source: CBN, Gifted Hands Research

Without federal allocations, can local government in Nigeria operate? The answer is NO because the least state that contributes to the aggregate IGR only generates around 13 million naira which cannot even cater for salaries of all the workers in a month or two.

Over the period of 4 years, IGR of local government in Nigeria has increased by 35% from N24bln in 2015 to N32.5bln in 2018. 2017 represents the year which IGR was the highest during the period under review as IGR amounted to N38.2bln before declining by 14.92% to N32.5bln in 2018.

Illustration 4: Personnel Cost Vs Economic Development (2015-2018)

Source: CBN, Gifted Hands Research

Analysis of the 4 years period shows that personnel cost has averaged 10 times the amount spent on economic, social and community services during the periods. This means that for every 11 naira earned, 1 naira is spent on developing local communities, while 10 naira is spent on the remuneration of workers. It also implies that for every 1 naira spent on developing rural communities, 10 naira is spent on the remuneration of workers.

While personnel cost plunged by 13% from N905.60bln in 2015 to N788.70bln in 2016 due to the economic recession, the amount spent on economic, social and community development services fell by 44%, representing 32% more than proportionate the fall in personnel cost. This further indicates the priority of Local governments in Nigeria being skewed towards the remuneration of the workers over and above developing the communities. It could also mean that the local governments have more workers more than what they can take.

Conclusion

As at the time of writing this article, the total number of employees of all the 774 local government in Nigeria could not be ascertained as even the Nigerian Union of Local Government Employees (NULGE) does not have an official website. This would have helped in knowing the average amount of money paid to Local government employees in the country and compare with the amount of money spent in developing the local areas in the country. There are also stories of Local government chairmen and councilors relocating to the urban areas not long after being elected into their various offices. Thus, making them not have the interest of the citizens of their Local Government in mind, ultimately leading to a factor that inhibits the growth and development of local government in Nigeria.

Do you think local governments are doing things within their powers to generate revenue for themselves without relying on feral allocation? Please share your answers with personal examples in your Local government, in the comment section