The Much Damages Coronavirus has Done to the Global Stock Market

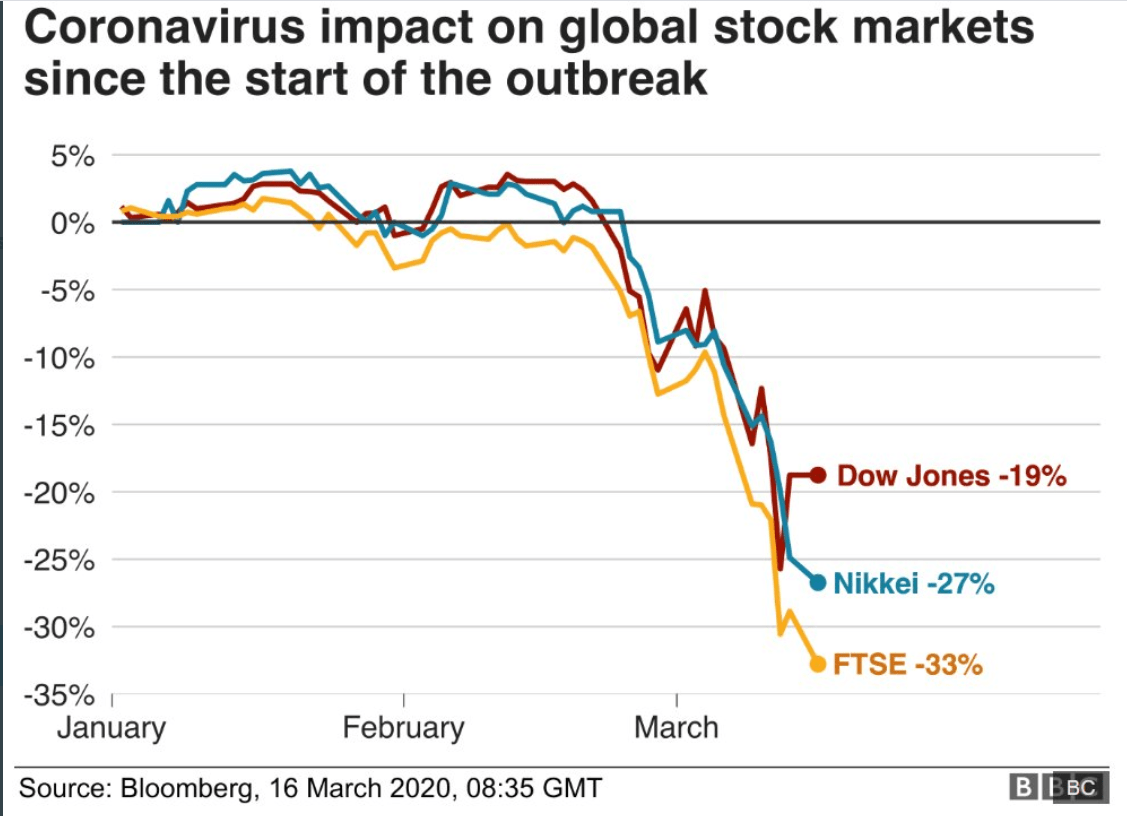

In the global stock market, the impact has been overwhelming as investors rally around to look for safe havens. The DOW-Jones, S&P 500 and NASDAQ have all entered into the bear market as a result of COVID-19.

According to the rules of the New York Stock Exchange (NYSE), trading on the floor of the exchange will be delayed for 15 minutes if the index drops by 7%. If the index drops by 13%, the circuit breaker will be triggered again and trading delayed for 15 minutes. However, if the index level drops by 20% in a day, then the trading will be suspended for that day.

In the month of March alone, the circuit breaker has been triggered three times. The first time on Monday 9th March when DOW, S&P500 as well as NASDAQ fell by 7.79%, 7.6% and 7.29% respectively at the end of trading. The circuit breaker was however triggered seconds after the market opened for the day as S&P500 dropped by. This was as a result of fears that arose with Saudi Arabia slashing down its crude oil price, thereby leading to a sharp decline in the price of crude oil in the international market. The fears of investors on the pandemic spreading faster was also a cause for the significant decline in stock market index all over the world. It was also the worst day for DOW since 2008 as it sank by more than 2,000 points

Adapted from Robin Pomeroy of WEF

On March 12 and 16, the circuit breaker was also triggered making it the third time in a month. This explains the very much damage the pandemic has caused and still causing for the world economy.

The New York Stock Exchange on Wednesday 18 March, announced that it will move to electronic trading starting from Monday 23 March. This is to prevent the spread of the pandemic after two people who work at the stock exchange tested positive for Coronavirus. This is the fourth time the NYSE floor will be closed. The first in 1963 when President John F. Kennedy was assassinated in 1963. The exchange was also shut down after the 9/11 terrorist attack.

Elsewhere, the Italian stock index (FTSE MIB) has tanked by 33.07% Year to Date and its 1 year return is -22.18%. Between February 21 and March 20, the FTSE MIB has tanked by 36.49% from an index level of 24,773.15bps to 15,731.85bps as at March 20.

Monday 9th March 2020 will always be referred to as BLACK MONDAY among investors as the breakdown in talks between Saudi Arabia and Russia impacted on all stock exchanges all over the world. And some stock exchanges recorded their biggest fall since the 2008 global financial crisis. Germany’s DAX, Spain’s IBEX and France’s CAC all tumbled more than 6%. The biggest sell-off was Italy, the country worst hit by Covid-19 in Europe, with the FTSE MIB index down nearly 10%.

With world market crashing twice in a week (March 9 (Black Monday) and March 12 (Black Thursday), 2020), it has now gone down to be part of history and nicknamed “Stock Market Crash of 2020” because of the devastating effect it had on the equities market all over the world. It was during March 12 that the FTSE 100 and DOW had their worst days since 1987. The significant decline was associated with the unbridled global fears about the spread of the coronavirus, oil price drops, and looming recession.

Impact on Commodities Market

The commodities market is also not left out as COVID-19 in conjunction with price war between Russia and Saudi Arabia, has successfully made oil price reach their lowest points since 2003. After the break-down in talks between Russia and Saudi Arabia on production cut, the price of crude oil (Brent) dropped sharply by 31.27% from $49.99 per barrel on Thursday March 5 to $34.36 per barrel on Monday March 9. The price of Brent is now hovering between $28 and $34 dollars per barrel from $66 per barrel at the beginning of the year. Commodities such as Gold, Silver, Copper and Natural gas are also not left out of the market rout.

Year to Date, the price of Gold has dropped by 1.32% to $1,498.8 as at March 20 while the price of silver has dropped significantly by 29.33% from $17.82 as at January 1 to $12.59 as at March 20.

Impact on the Nigerian Stock Market

When the first case of Coronavirus was discovered in Nigeria, just two stocks gained at the trading day while the rest either lost or remained constant in value. When the second case was confirmed, there was massive selloffs and only one stock recorded gain during the trading day while 44 stock recorded decline and the remaining stocks listed on the NSE had a constant share price.

As at the time of writing this report, the Nigerian All Share Index has lost 17.30% Year to Date, while it lost 15.33% between February 20 and March 20, with the worst weekly decline (13.49) occurring at the week ended March 13 as investors lost N1.84 trillion during the week. During the same week, there was only two gainers week on week. The NSE as at today March 21, 2020, is currently performing a disaster recover test according to the information obtained from their website.

So where is Investors Keeping their Money?

If there can be decline in all investible financial instruments and commodities, then it means investors prefer to hold their cash more than anything else. With this, we can say CASH IS KING whenever there is global meltdown as investors will prefer to keep their money with them due to speculations about future economic performance. For example, the Central Bank of Nigeria (CBN) auctioned OMO bills on 19th March but ended up not selling. The reason is not far-fetched. The investors demanded for high yields (16% for 182 days and range of 17% to 18.25% for 362 days OMO) but the CBN could not afford the rate because it will amount to an increase in cost of servicing the debt. Hence, the CBN ended up not selling any amount of OMO during the auction.

That said, it does not mean that some investors are not taking advantage of undervalued stocks by buying shares and other financial instruments due to selling pressures causing their prices to fall.