How Nigerian Banks Performed in 2019

We cover all the 14 listed banks on the Nigerian Stock Exchange based on the their 2019 full year audited financial reports.

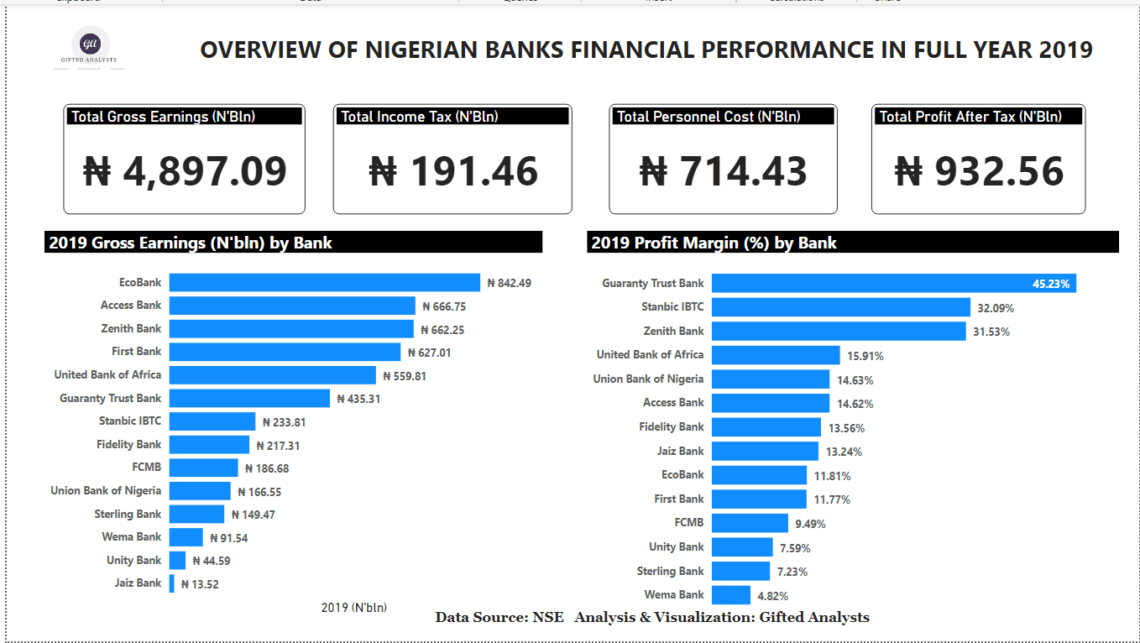

From their respective top lines, Eco Bank generated the highest gross earnings at N842.49 billion and this represents 9.05% growth in gross earnings when compared to N772.56 billion it recorded in full year 2018. Zenith Bank, Access Bank, UBA and GTBank in total recorded 68.7% of the entire gross earnings of the 11 banks covered. While Zenith Bank earned N662.25 billion in gross earnings, UBA recorded N559.81 billion and GTBank printed gross earnings of N435.31 billion.

Based on growth in gross earnings, Jaiz bank had the greatest growth when compared to the gross earnings of 2018. The bank printed growth rate of 79.76% in gross earnings at it earned N13.52 billion in 2019 compared to N7.52 billion in 2018. Sterling bank and GTbank recorded the slowest growth at 0.51% and 0.14% respectively.

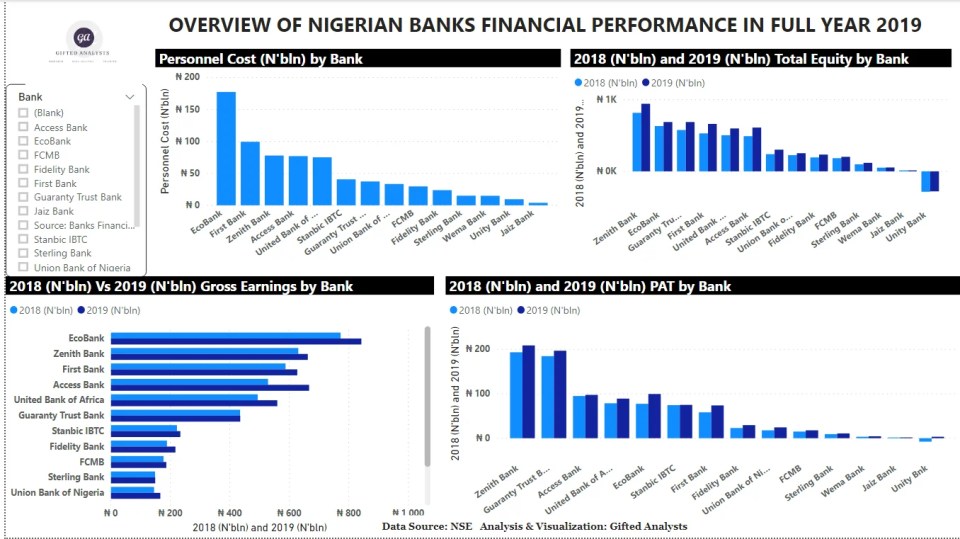

In terms of Profit After Tax (PAT), Zenith Bank appears to be the most profitable bank in Nigeria as it recorded N208.84 billion in PAT in 2019 compared to N193.42 billion in 2018. A major factor we can attribute to this is the bank’s drive in increasing its non-interest income while also reducing operating expenses. We highlight that net income on fees and commission printed at N100.11 billion compared to N81.81 billion in 2018. We also saw that operating expenses declined by 6.13% to N129.45 billion in 2019.

Although Jaiz Bank recorded the lowest PAT (N1.79 billion), it had the highest growth rate in PAT as its PAT grew by 114.63% in 2019, compared to 37.22% PAT growth of Union Bank (second best in terms of growth in PAT). Stanbic IBTC however had the slowest growth in PAT as it printed 0.81% marginal increase in PAT from N74.44 billion in 2018 to N75.04 billion in 2019.

Based on Profit Margin, GTBank remains the most efficient bank in Nigeria has it has the highest profit margin in 2019. The bank’s profit margin in 2019 was 45.23% compared to the profit margin of 42.49% in 2018, all aided by the low interest expenses of the bank. For example, GTBank had interest expenses of N51.25 billion in Q3 2019 compared to First Bank’s interest expenses of N116.03 billion which is more than double that of GTBank.

On personnel cost, Zenith Bank generated twice as much as GTBank in terms of personnel cost in 2019. While Zenith Bank recorded N77.86 billion in personnel cost in 2019, GTBank’s expenses on personnel was N37.28 billion. Access Bank comes second in the rank of personnel cost as its personnel expenses was N76.96 billion in 2019. We therefore note that the amount Access Bank spend as personnel cost in a month amounts to roughly N6.66 billion per month, and the N1 billion it donated to the Nigerian government to fight against COVID-19 was 15% of what the bank spend on personnel cost in a month.

Based on the Loan-to-Deposit Ratio (LDR), Fidelity bank has the highest LDR (92.05%) of all the 11 banks on our radar. The bank’s total loan to customers was N1.13 trillion in 2019 while it received N1.23 trillion in customers’ deposits during the same period. Trailing Fidelity bank in terms of LDR is Stanbic IBTC which printed LDR of 83.43% in 2019 followed by Sterling bank with 68.87% in LDR. Of the 11 banks, Wema Bank, UBA, Zenith Bank and GTBank all have their ratios below the 60% threshold with Wema Bank recording the lowest LDR at 50.01% as at December 2019.

For questions, opinions, corrections and contributions, please drop them in the comment section. You can as well contact the writer on Twitter @K2ice_JR

Additionally, should you need data backed research and analysis for your business or research needs, you can contact us with your message in the comment section or send a mail to info@giftedanalysts.com