COVID-19 & Cheap Oil: An SSA Market Update

Being what we learnt from the RenCap Securities Conference Call held on 25th March 2020

According to the global chief economist of RenCap, Charles Robertson, the COVID-19 outbreak in Italy shows that the 12 days lag before the virus infection rate goes up, is valid. As such, New York is expected to experience a peak in the virus outbreak in the next two weeks.

The trouble with Italy was that it enacted a lock down at 12 cases per 100,000 people compared to China’s lock down at 0.01 cases per 100,000 people. South Africa is expected to enact a lock down starting from today 26th March 2020. If this is done, then it will be positive for the country as its lock down is two weeks ahead of the United Kingdom and Italy. Also, the lock down is starting at a time when the virus case is exactly 1 case per 100,000 people. Thus, South Africa has a better chance of survival and it might be as good as today.

That said, Africa has a whole has a better chance of survival than other continents. Africa has much younger population compared to Spain, Italy and China. Even where the health care systems are getting overwhelmed, Africa is seven times less vulnerable to the virus than Italy.

However, the outbreak of the virus will cost a lot of money in Sub-Saharan Africa as cost of borrowing is now high especially when yields are looked into in countries such as Nigeria, Kenya and Ghana.

Challenges to the Sub-Saharan African Countries

Although only about 3% of the population of Sub-Saharan Africa are over 60 years old (23% in Italy), the health care system will be over stretched and this is majorly due to the quality of spending towards the development of healthcare in Sub-Saharan Africa. Average healthcare spend is $78 in Sub-Saharan Africa compared to over $3,000 in EU.

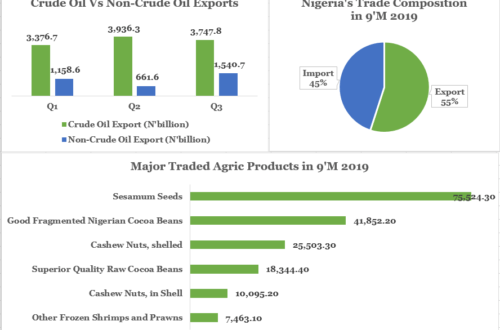

Due to the methods used by the different government in containing the virus, global demand shock is expected and this will spread all through the Sub-Saharan countries. The fall in global oil prices also expected to have a toll on finances of governments that depend on it.

Overall, GDP falls but agriculture remains favourable.

Source: Rencap Securities

Nigeria’s Economic Outlook

The pandemic led to OPEC and OPEC+ negotiating a production cut to meet depressed demand and keep oil prices at favourable level. However, due to the breakdown of talks between Saudi Arabia and Russia, crude oil price fell sharply and is currently hovering between $26/barrel and $33/barrel. The collapse in the oil price has therefore led to reduction in government finances. This has led the CBN to embark on measures towards a single currency regime. This is commendable with particular emphases on the currency devaluation. However, the devaluation is still small when compared to Rencap’s fair value of N410/$.

Based on the foregoing, Nigeria is expected to have a negative growth rate of -4% in 2020 (previous estimate= 2.2% growth YoY). The economy will be in recession in 2020.

On the back of the volatility of the Naira and given the outlook on how the market share play between Saudi Arabia and Russia plays, the Naira is projected to fall further to N420/$ through 2020. Depending on the oil price movement in the near term, the BDC rate will be the most volatile. NAFEX AND I&E will be less volatile while the official exchange rate will be the least volatile.

Inflation rate is also expected to move up on the back of supply shock with increased demand for goods and services. The benchmark interest rate (MPR) is expected to remain flat at 13.5% all through 2020.

The country’s foreign reserve is currently sitting at c.$35 billion. With OMO consisting of $12 billion of this reserve and SWAPS taking less than $20 billion, FX restrictions are likely and it is expected that more forex restriction will be imposed on the demand side.

The Nigerian government is projected to seek concessional financing which will shoot up external debt. Thus, widening the country’s fiscal deficit in the year and going forward.

Option for Nigeria given the Revenue Crunch

The only option for the country is in seeking cheap fund. This can be done by increasing domestic debt holdings as yields have increased in foreign debt market. The Nigerian government can also apply for concessions from the World Bank and IMF (This is already on the table).

Ghana’s Economic Outlook

The Ghanaian economy is projected to grow at 3.5% YoY compared to 6% growth rate earlier predicted. The exchange rate is also expected to be weaker at 6.14 Cedis to a dollar. Lower oil prices will be good for the Ghanaian economy and will lead to a moderation of inflation rate at 7.5%-8%. The country’s benchmark interest rate is also expected to remain flat at 14.5%.

Kenya

In the consumer segment of the Kenyan economy, there is no evidence that the citizens are buying commodities to stock. From the distributors, the people are not buying to stock. Also, they are not buying a whole lot of bears due to the fact that it cannot be stored long in the fridge; they are buying more of coca-cola and vodka. Buying activities is also witnessed in essentials.

The Kenyan economy is expected to have a moderate current account deficit which will amount to 2-2.5% of GDP on the back of low import prices of oil.

Conclusion

Of the three countries covered, Kenya will be the most resilient to COVID-19; Ghana will be less resilient while Nigeria will be the most affected by the pandemic.

2 Comments

Solutionwheels

Well Done Gifted hands team.

This Coronavirus will hit us like Tsunami. We are being hit with 2 things at a time

1. Fall in the price of crude oil

2. Halt to the Nigerian Economy (measure to curtail the virus

The underlying effect could be massive.

The government and CBN are doing all within their power to alleviate the effect. We hope it pays off atleast.

Abdulazeez Kuranga

Thank you for the comment Solutionwheels.

You have said it all. Nigeria’s problem is two-folds- oil price falling steadily and economic impact of COVID-19. The outlook is not so favourable due to the fragile nature of the economy and we hope the combined efforts of the private sector, monetary and fiscal authorities, will yield good fruits.