Understanding Nigeria’s Budget Performance as Revenue Keeps Under-Performing

Introduction

In order to keep the affairs of a country running while protecting the interests of the citizens, the government of a country works on a budget which defines its income and expenses for operation in a fiscal year. This is the fiscal tool of the government as it comprises how the government intends to spend money as well as how it will raise the money to be spent. When revenue is greater than expenditure, then there is a surplus which can be rolled over to the next year and boost the performance of the government. However, when there is deficit, it means expenditure is greater than income. As such, there is the need to borrow to fill the gap.

For Nigeria, data gathered has shown that expenditure has always been greater than the revenue generated by the government. In fact, over 38 year period, the Nigerian government has only recorded fiscal surplus in two years- 1995 and 1996. Surplus was N1 billion in 1995 and N32.05 billion in 1996. The budget over the years is also characterized by over estimation of budgeted revenue in order to justify for the proposed expenses to be incurred for each of the fiscal years.

This research article therefore aims to explain Nigeria’s budget performance by comparing it with the actual performance in each of the fiscal years. While the article gives explanations of some trends from 1981, it is specifically focused on budget performance from 2010 to 2019.

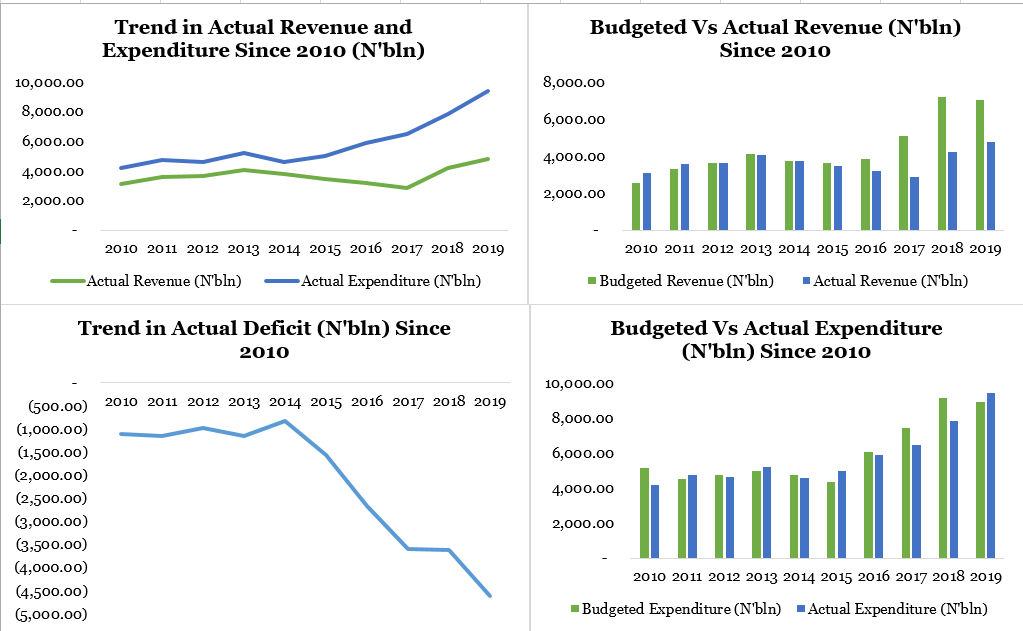

Actual Budget Deficit of N4.62 trillion in 2019 is 185.69% more than the Budgeted Deficit

In the first quarter of 2019, the retained revenue of the Federal Government (FG) was N1.11 trillion while it spent N2.51 trillion, thereby leading to a deficit of N1.4 trillion. In the second quarter of 2019, revenue dropped by 11.99% to N978.39bln while expenditure dropped to N2.39 trillion from N2.51 trillion recorded in the first quarter. This therefore led to a 0.58% increase in budget deficit to N1.41 trillion in the second quarter of 2019.

In the third quarter of 2019, budget deficit was N675.21bln as total revenue during the period was N1.74 trillion while total expenditure was N2.41 trillion. In the last quarter of 2019, the CBN estimated the total revenue to be N936.72 billion while total expenditure was N2.07 trillion. When combined together, total budget deficit in 2019 was N4.62 trillion. Recall that the budgeted deficit was N1.92 trillion. When compared, it shows the actual deficit in 2019 was 185.69% more than the budgeted deficit.

Actual Revenue Has been Under-Performing Since 2015

From 2010 to 2019, actual revenue was greater than the budgeted revenue in 2010, 2011 and 2014. In 2010, actual revenue was more than the budget revenue by 23%, thereby making it the highest budget performance since 2010.

Source: Based on the Data Obtained from the CBN and Budget Office

In 2015, actual revenue was N3.43 trillion while the budget revenue was N3.60 trillion, representing 5% budget under-performance. In 2016, actual revenue dropped by 7% to N3.18 trillion from N3.43 trillion recorded in 2015. When compared with the budgeted revenue of N3.86 trillion, it shows the revenue target in 2016 also under performed and by 17% this time around. In 2017 and 2018, the actual revenue underperformed by 44% and 42% respectively. And by 2019, data obtained from the CBN shows revenue underperformed by 32% as actual revenue was N4.77 trillion while the budgeted revenue was N6.998 trillion. Overall, revenue since 2015 grew by 6.8% on a CAGR basis. When compared with actual expenditure, it means that if the FG earns 1 naira, it spends 2 naira.

Actual Expenditure Grew by 13.49% in 5 Years on CAGR Basis

Though the expenditure of the FG underperformed by 19% in 2010, this bounced by in 2011 as actual expenditure over performed by 5%. Budgeted expenditure in 2010 was N5.16 trillion while it was N4.48 trillion in 2011 of which N4.71 trillion was actually spent in 2011. While presenting the 2011 budget to the joint session of the National Assembly on December 15 2010, former President Goodluck Jonathan stated that the rise in expenditure in 2010 was a result of the exceptional outlays to meet wage increases granted to civil servants, as well as some other exceptional items such as the INEC voters’ registration exercise.

Source: Based on the Data Obtained from the CBN and Budget Office

In 2015, the FG spent more than it budgeted for as actual expenditure was N4.99 trillion while budgeted expenditure was N4.63 trillion, and this represents 14% expenditure over performance. Even though expenditure underperformed in 2017 and 2018, actual deficit was still large at N3.61 trillion and N3.63 trillion respectively. By 2019, actual expenditure was more than budgeted expenditure by N474.41bln, representing 5% over performance in expenditure.

Fiscal Trend Shows Reliance on a Single Commodity is Unsustainable

It is worthy to note that since 1981, Nigeria has only recorded actual revenue more than actual expenditure, twice and those periods were 1995 (Revenue: N249.77bln; Expenditure: N248.77bln), and 1996 (Revenue: N369.27bln; Expenditure: N337.22bln).

From the illustration below, it evident that Nigeria’s expenditure and revenue move in the same direction even though the growth in expenditure always outweigh the growth in revenue. If revenue rises, expenditure also rise but more than an increase in income. This negates Keynes psychological law of consumption which states that consumption tend to increase as income increases but the increment in consumption is less than the increase in income. Hence, the consumption coefficient has a value greater than 0 but less than 1.

The only exception to the above explanation was in 2017 when expenditure grew by 10.2% but actual revenue dropped by 10.6% as well as in 2016 as revenue also dropped by 7.2% from N3.43 trillion recorded in 2015. These were the periods when the country was in recession.

Source: Based on the Data Obtained from the CBN

On a Compounded Annual Growth Rate (CAGR) basis, total actual deficit grew by 15.38% annually. Largest growth in deficit was recorded in 2015 and 2016 as actual deficit grew by 86% and 71% respectively. Recall that the Nigerian economy entered into economic recession in 2016 and was out of recession in Q2 2017.

Source: Based on the Data Obtained from the CBN

In 2010, the Nigerian Government recorded deficit of N1.1 trillion and this grew by 4.8% in 2011 to N1.16 trillion. In 2012, actual deficit was N975.78bln but this grew by 18.2% in 2013 to 1.15 trillion. Even when crude oil price was its highest in 2014, the Federal Government still recorded actual deficit in its fiscal operation as actual deficit was N835.71bln even though it is the lowest recorded in 10 years.

Fast forward to 2019, revenue of the federal government is now almost equal to the deficit recorded during the period. Total actual revenue was N4.77 trillion while the total deficit was N4.62 trillion. It is therefore saddening that at this stage, the country’s budget is still largely determined by the international price of crude oil. Nigeria has a revenue problem which reliance on crude oil will never solve.

Conclusion

From the foregoing, it is seen that even though crude oil has been the mainstay of the Nigerian economy, data shows that reliance on it is not sustainable as the country has been recording deficit in its fiscal operations even when the price of crude oil fluctuates to the favour of the country. Using a population of 198 million citizens, actual revenue per citizen in 2019 is at N24 thousand per citizen. Revenue is not forthcoming, expenditure keeps increasing and as such, deficit also increases. This makes debt servicing become worrisome.

With the new finance act set for implementation from the 1st of February 2019, the FG expects an increase in its revenue and states will also be able to fund an increase in the minimum wage. This means that even with the finance act, revenue problem will still persist as the increase in revenue will be offset by the increase in expenditure brought about by the increment in minimum wage. As such, increase in minimum wage cancels out increase in revenue from VAT.

This therefore explains the dire need to declare a state of emergency in the non-oil sector to make it a viable source of income to the country. Without the non-oil sector performing in bringing revenue to the country, then the revenue problem of the country will keep on persisting because there is a limit to how the citizens can be taxed according to the Laffer Curve (which explains that increase in taxation brings about increase in revenue. But when tax is increased up to a level, a marginal increase will then lead to a reduction in government revenue due to structural factors such as companies folding up, and workings being laid off due to increase in the cost of doing business and so on).

Please drop your comments in the comment section or contact the writer on 08098374664

You May Also Like

Download Workforce Past Questions

October 10, 2019

Download Past Questions for Union Bank Management Trainee Program

October 21, 2019