-

2021-2023 MTEF: Key Implications and Market Impact

We recently received the 2021-2023 Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP) released by the budget office of the Federation. We have thus provided an update on the key highlights,…

-

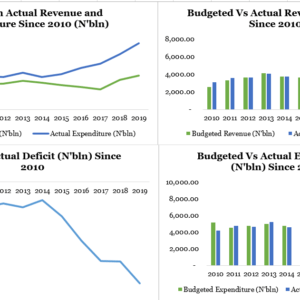

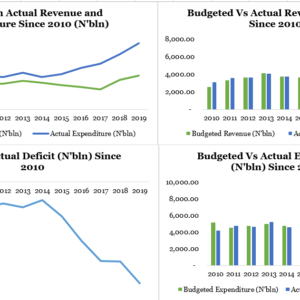

Data on Nigeria’s Budgeted and Actual Revenue and Expenses (2010-2019)

Over the past 10 years, Nigeria have recorded surplus (actual revenue minus budgeted revenue) in revenue during three periods and those periods are 2010, 2011 and 2014. In 2010, budgeted revenue was N2.52…

-

Data on Electricity Costs of MDAs in Nigeria (2020 Budget)

As with every budget which detail expenses to be incurred by a government over a period of time, it contains expenses from salaries down to the lowest items in the budget. The data…

-

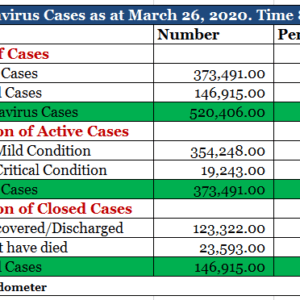

COVID-19: The Cost of a Lock Down- A Case of Kwara State

Effective from Friday 27th March, the Kwara state government announced a partial lock down of the state as a preventive measure against the spread of coronavirus (COVID-19). As such, all motor parks, public…

-

Understanding Nigeria’s Budget Performance as Revenue Keeps Under-Performing

This research article aims to explain Nigeria’s budget performance by comparing it with the actual performance in each of the fiscal years. While the article gives explanations of some trends from 1981, it…

-

Kwara State 2020 Budget: Good Intentions, Faulty Assumptions

Total revenue as at October 2019 was N85.12 billion which shows that revenue underperformed by 34.69% when compared with N130.38 billion projected revenue for 2019. Total expenditure as at October 2019 on the…

-

Is Kogi State's 2020 “Budget of Prosperity” a Hoax?

In this insightful piece, we analyzed the 2020 budget of Kogi state with special focus on the budget allocation for the Kogi State government house. We also identified some items which we believed…

-

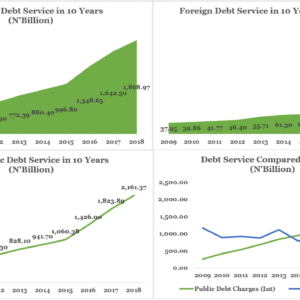

Nigeria Has Both Debt and Revenue Problem

This research article aims to provide answers to the differences in analysts opinions on Nigeria having a debt problem or revenue problem by providing trend analysis of debt servicing in Nigeria, as well…

-

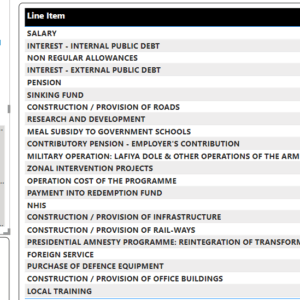

2020 Nigerian Budget: The Questionable Little Line Items

While there have been different efforts from all corners talking about the big figures, this article however aims to breakdown the little figures which seem not to matter (to some individuals) but will…

-

VAT 101: Meaning of VAT Registration Threshold as Announced by President Buhari During 2020 Budget Presentation

Currently, section 8 of the VAT law requires a taxable person (an individual, body of individuals, companies, etc) to register for VAT with FIRS and charge VAT at 5% on the supply of…