Macroeconomic Analysis and Comparison of Some Selected Countries in Africa

Introduction

With an estimation that over half of global population growth through 2050 will come from Africa (UN Estimates), the continent has the world’s fastest growing population. The continent is a 2.49 trillion dollars economy in terms of GDP (a total of 54 countries) and it houses around 1.2 billion people. The aim of this research is therefore to provide macroeconomic analysis of four countries (Nigeria, Kenya, Egypt and South Africa) given the fact that they constitute the largest markets of Financial Technology in Africa.

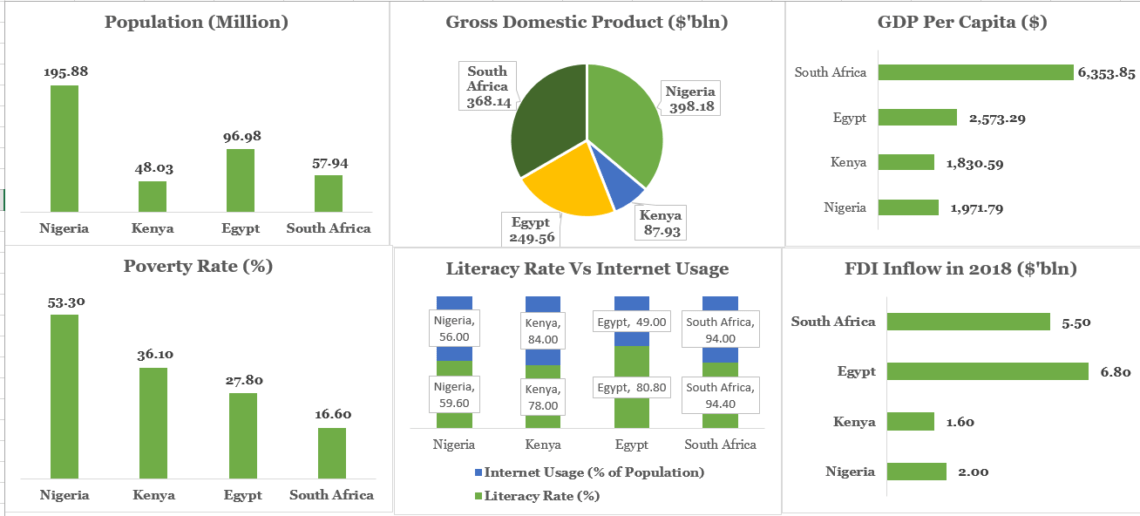

Population Growth Rate in Nigeria is Highest

Of the four countries under review, the Nigerian population growth rate is highest at 2.5% as South Africa has the lowest population growth at 1%. Nigeria (195.88 million) is therefore the most populous country in Africa and has more than twice the population of Egypt (96.98 million) which is the second largest country in Africa in terms of population.

Based on the Data Obtained from the IMF WEO Database

Nigeria also tops in Terms of GDP but Growth Rate Slows

In terms of GDP, the total monetary value of all goods and services produced in Nigeria is about 5 times the size of the GDP of Kenya ($87.93 billion) and is the largest economy in Africa followed by South Africa with a total nominal GDP value of $368.14 billion as at 2018. However, in terms of growth rate, the two giants of Africa are the ones currently slowing down the continent’s growth rate as Nigeria’s growth rate in 2018 was 1.9% while that of South Africa was 0.6%. Rocked by electricity crisis, policy uncertainty and weak investor sentiment, the World Bank projects the South African economy to grow by 0.8% in 2019. For the Nigerian economy, a major factor leading to slow growth in the economy is due to the mono-cultural nature of the economy whose GDP remains sensitive to fluctuations in international oil price. Kenya and Egypt on the other hand are among the fastest growing economies in Africa as the GDP growth rate of the two countries in 2018 were 6.3% and 5.3% respectively.

Based on the Data Obtained from the IMF WEO Database

African Countries are Either Middle Income or Low Income Countries

According to the World Bank, middle income countries are home to 75% of the world’s population and 62% of the world’s poor. Accordingly, the World Bank in July 2019, classifies middle income countries as those with income per capita between $1,026 and 12,375. Of this classification, lower middle income countries are those with income per capita between $1,026 and $3,995 while upper middle income countries are those whose income per capita is between $3,996 and $12,375.

As such, while only South Africa is classified at an upper middle income country, the rest of the countries under review are lower middle income countries with Kenya having the lowest GDP Per capita at a value of $1,830.59. This means that if the whole of Kenya’s GDP is divided equally among its population, each citizen will go home with $1,830.59.

Based on the Data Obtained from the IMF WEO Database

There is a Strong Positive Correlation between Literacy Rate and Internet Usage

Among the four countries under review, literacy rate is lowest in Nigeria at 59.60%. This means that of the total population of 195.88 million in 2018, 116.74 million are literates while the remaining 79.14 million citizens are illiterates. This therefore shows that Nigeria’s literacy rate is low when compared with other countries, as South Africa has a literacy rate of 94.4%, while Kenya and Egypt have literacy rates of 78% and 80.8% respectively.

In terms of the proportion of the population using the internet, 94% of South Africans (representing the highest) use the internet while 49% of Egyptian Population use the internet. Furthermore, while 84% of Kenyan population use the internet, 56% of Nigerians use the internet. Checking the figures, and with the exception of Egypt, it shows that there is a strong relationship between being educated and being able to use the internet. That is, the higher the literacy level, the higher the ability to use the internet.

Based on the Data Obtained from CIA Fact-Book and FT Partners

Nigeria as the Poverty Capital of the World

With 53.3% of the citizens (representing 104.40 million citizens) living on less than 2 dollars per day, Nigeria is said to be the poverty capital of the world as more than half of its citizens are living below the poverty line. South Africa however, has the lowest poverty rate among the countries under review as 16.6% (9.6 million) of its citizens are living below the poverty line, as the poverty rates in Kenya and Egypt are 36.1% and 27.8% respectively.

Based on the Data Obtained from the World Bank

Egypt Attracts the Most Foreign Direct Investment

Foreign Direct Investment (FDI) is defined as an investment in the form of another entity based in another country, controlling ownership in a business in a country. It involves citizens of other countries investing in shares or other capital structure in another country during a given period of time. The more the citizens of the other countries find investment attractive in a country, the more they invest in that country. Therefore, in 2018, Egypt attracted the most FDI as it attracted as much as 3 times the total FDI of Nigeria in 2018, followed by South Africa ($5.5 billion).

Based on the Data Obtained from the World Bank

Other Macro-Economic Indicators

In terms of ease of doing business, it is easier to do business in Kenya than it is in Nigeria, Egypt and South Africa. This is based on the 2019 ease of doing business report of the World Bank. In 2019 therefore, Kenya ranked 61st position of the 194 countries, while South Africa came second with a rank of 82nd position. Nigeria however, ranks the lowest of the four countries under review in terms of ease of doing business as it was ranked 146th in the ease of doing business report of 2019 while Egypt was ranked 120th position.

In terms of the percentage of the population that do not have access to financial services, Egypt ranks highest in percentage as only 32% of Egyptians have access to financial services while the remaining 68% are unbanked. This is further explained by the 2019 African FinTech Industry Research of FT Partners which explained that only half of Egypt’s Small and Medium sized businesses participate in the formal banking sector as 68% of the Egyptian Population remain unbanked. South Africa however, has the lowest percentage of citizens unbanked as 33% of its population are unbanked.

Looking closely at the percentage of citizens that have access to internet services and the percentage of citizens that are unbanked, it shows that there is a negative relationship between using the internet and not having access to financial services. An increase in internet service usage means that unbanked population will reduce because the increased internet usage spurs an individual to use financial services. For Kenya with 84% of its citizens being able to use the internet, its unbanked population was 44% in 2018. For South Africa which has internet usage at 94% (highest among the countries under review), its unbanked population is lowest at 33%.

Conclusion

Based on the foregoing, it is seen that the South African economy is fairly better than the other economies reviewed excluding the growth rate of the economy which is the lowest among the countries reviewed. The South African economy has a sizeable population but grows more than the growth in GDP. The Kenyan economy however, represents an economy to look out for in terms of technology or digitally as it is performing very well, many thanks to M-Pesa which has been seen as a role model for other mobile money technologies. FDI inflow into the economy is however low, but has a prospect with its economy growing at a high rate compared to the other countries (with emphasis on Nigeria and South Africa).

The Egyptian economy is also not left out in terms of performance as its GDP growth rate outperforms its population growth rate, thereby enabling it be a top destination for FDI in 2018. Although it has a high literacy rate, internet usage among the citizens is relatively low and this therefore contributes to the country having a high unbanked population at 68%.

For Nigeria, the giant of the continent in terms of population and economy, literacy rate of the country is relatively low as the country has the highest poverty rate in the world at 53.3%. in terms of doing business, the country is worse off compared to the other countries surveyed but it still represent a huge market for financial technology in Africa as Financial technology investors leverages on the country’s high unbanked population to create businesses for themselves.

For enquires, corrections and suggestions, you can leave a reply in the comment section, or contact the writer on 08098374664.

You May Also Like

Kwara State 2020 Budget: Good Intentions, Faulty Assumptions

December 22, 2019

With Saudi Aramco, Oil is not Dead Yet

December 13, 2019